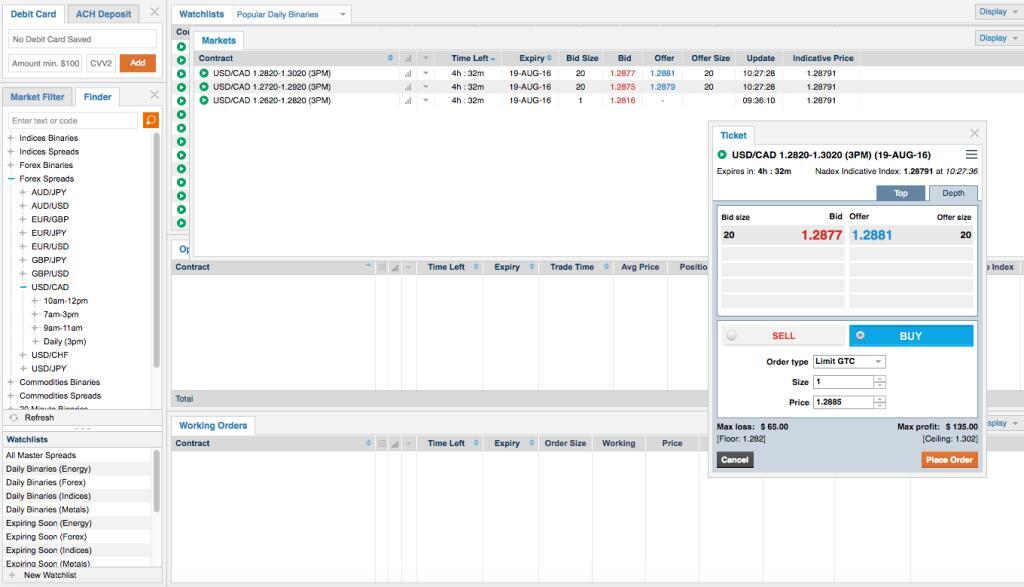

The premarket session is an important period because most news events usually come out in the morning or in the extended hours. Instead of spending one hour finding opportunities, you can use a watchlist and find them within minutes. You can also create your own watchlist using popular free platforms like Investing and TradingView. Bid is the maximum price that a person is willing to pay while ask is the maximum price that a seller is willing to sell. The bid is usually on the left while the sell is on the right.

It involves the use of technical indicators and conducting chart analysis. Some of the top chart analysis patterns to consider are triangle, head and shoulders, and rising and falling wedges. Therefore, focusing on premarket movers will help you identify good trading opportunities.

Stock Chart Patterns

NIO has proven that it can make that happen in the past. Like most things in the EV sector, the 2021 hot market’s enthusiasm was premature. Make no mistake, this is not a “cheap” stock, even after having lost over 85% of its 2021 value. Testimonials on this website may not be representative of the experience of other customers.

It’s actually a heck of a lot easier for it to happen than an IPO — which means it happens quicker. On the other hand, small-cap companies don’t always have the same perceived value because they’re not as established, well known, or trusted. They might be newer companies, or they might be in up-and-coming industries.

Create Your Own Growth Stock Watchlist

The strategy is what separates gambling/guessing and methodical high probability trading. Having a day trading strategy is what separates you from the hordes of beginners hitting market orders chasing momentum and getting stuck afterwards. A new business wouldn’t just open up shop and hope for the best.

It’s important to cut your losses quickly with stocks of any size, so always set a stop loss. Maybe it’s a mental stop, or maybe it’s an actual stop-loss order. But make it part of your plan to determine the point you will cut losses at if things start going against your trade. If you’re investing your money, stocks of different market caps slot right into a balanced portfolio.

Examples of large-cap stocks

Putting together a day trading strategy is not a one-off process. There is no generally accepted definition of what large-cap and small-cap companies are. In our case, we will define a large-cap company a market cap of more than $10 billion. Companies with a market cap of more than $100 billion are known as mega caps.

- The paradox of day trading is that it may seem like a good idea, depending on how the stock market is performing.

- They can range from technical patterns like breakouts, breakdowns, reversions and reversals to defined price patterns like double tops, double bottoms, head-and-shoulders and cup and handles.

- Scalpers are risk adverse traders that will use larger share size allocations to trade high probability set-ups to “scalp” smaller price moves and price targets.

Most of the time, day trading is not profitable, but it can be profitable. Investors sometimes succeed at predicting a stock’s movements and raking in six-figure profits by accurately timing the market. These traders may be dabbling in penny stocks to achieve their outsized returns, or they may simply get lucky on occasion — as many people do at casinos every day. These can be segmented by market capitalization and or industry or theme.

Share

Looking at chart patterns will help you determine if it’s a good time to buy a large-cap stock, and help you figure out appropriate entry and exit points. Companies with a market cap between $10 billion and $200 billion are considered large-cap stocks. Here is the process of creating and refining a day trading strategy.

No testimonial should be considered as a guarantee of future performance or success. Inflation can have a big impact on the stock market, leaving unprepared investors in for a bumpy ride. In this article, we’ll explain why inflation impacts the stock market and take a closer look at how the stock market has reacted to inflation in the past. In this article, we will look at the top types of companies by size and how to select the ones to trade. I was going through some of his trade review videos and noticed that he is trading with the broker TradeStation connected via TradingView – something I do myself. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services.

In this industry that is rife with fake gurus and fraud, I don’t think wanting some level of transparency to verify his trades is that much of an ask. I keep asking myself, “if I had a 95%+ win rate, would I not want to jump through some hoops and prove to everyone that I’m for real? ” He could quell all of these questions and concerns people have and triple his membership in a heartbeat.