Choosing a Good Brokerage Partner

To choose a proper business firm while assessing a huge number of contributions may prove challenging. Thus, we aid decisions by surveying agents, giving in-depth data, and giving apt support for a trader to make a sound decision. In this regard, we would like to present IFC Markets.

What is IFC Markets?

An international Forex and CFD Broker, IFC Markets has served over 20,000 customers for 12 years. It has provided its clientele with boundless exchanging instruments and numerous chances to be successful in the trade. IFC Markets hails from the IFCM, a group engaged with the improvement of ventures in the financial field.

IFCM allows a speedy exchange of 50 cash sets, 400+ stocks CFDs with 100% profit change, and up to 1:30 leverage, 19 commodity futures with no expiration, 4 CFDs on ETF Traded in NYSE and CFDs on Crypto Futures. Their valuing model and statements themselves are given from bank-liquidity suppliers that consequently move customers’ requests to the interbank market.

The IFC Markets Site

Since the exchanging condition isn’t the main focus of effective exchanging, brokerage companies understand the need to help and teach their clients different trading strategies. The instruction materials are provided through the Online Trading Academy, Video instructional exercises, books, and glossaries alongside day-by-day specialized investigation and systematic recordings that built by specialists. At the same time, client care offers 18 dialects by consistent accessibility and different contact ways.

Knowing the Ropes around IFC Markets

For one to completely understand what the IFC offers, one should consistently check the most significant data of the dealer’s proposition. For this reason, the following are discussed at length:

- Is IFC Markets a Mere Scam?

- The Exchange Platform

- Trading fees with conditions that comprise of spread and medium-term charge

- Leverage

- Deposit and Withdrawal conditions

IFC Markets: A Scam?

The IFC Markets is an entity set up by IFC Markets Corp. and the British Virgin Islands with the permit of the British Virgin Islands Financial Services Commission (BVI FSC). Despite being offshore, IFC Markets is incorporated with IFCM Cyprus Limited, and a Cyprus Investment Firm enlisted under the CySEC.

The IFC Markets Permit

The European guidelines make the WiIFC Markets safe and, therefore, a legitimate entity. The IFCM CYPRUS LIMITED is a part of the CySEC from the ICF (Investor Compensation Fund). As a legal entity, it strictly follows the European Commission’s MiFID. This ensures benefits within the EEA securely.

For the most part, the clients’ security is ensured through reserves and investment plans. IFCMARKETS. CORP. also takes repayment for Financial Institutions Insurance in the AIG EUROPE LIMITED.

IFC Markets Trading Platforms

IC Markets exchanges are administered through MetaTrader4 (MT4) and MetaTrade5 (MT5). The IFCM also has a license for NetTradeX.

Both the MT4 and MT5 don’t require complicated technical know-how. These exchange platforms are intuitive and are accessible through multiple devices. All stages and functionalities are customizable to tailor-fit the user’s needs regardless of which devices he or she chooses to employ.

As already mentioned, another software that the IFC uses is NeTradeX. The platform had garnered a good reputation and had thus earned quite a following amongst traders. NeTradeX employs the GeWorko Method with the formation of possessing instruments, Portfolio Trading, and so forth. The NeTradeX instruments include standard ones alongside engineered instruments built by specialists.

The IFC Markets Stage

The exchange terminals that the IFC uses are a standout from the rest as it provides an insight with advisors and a graphical interface to see positions and requests, custom markers, and administration utilities. The company allows its users to work on NetTradeX Advisors alongside other platforms. The NetTradeX Advisors allow for the use of the fundamental functions of the terminal, may it be through manual mode or the calculations of a predetermined code.

IFC Markets Trading Costs and Spread

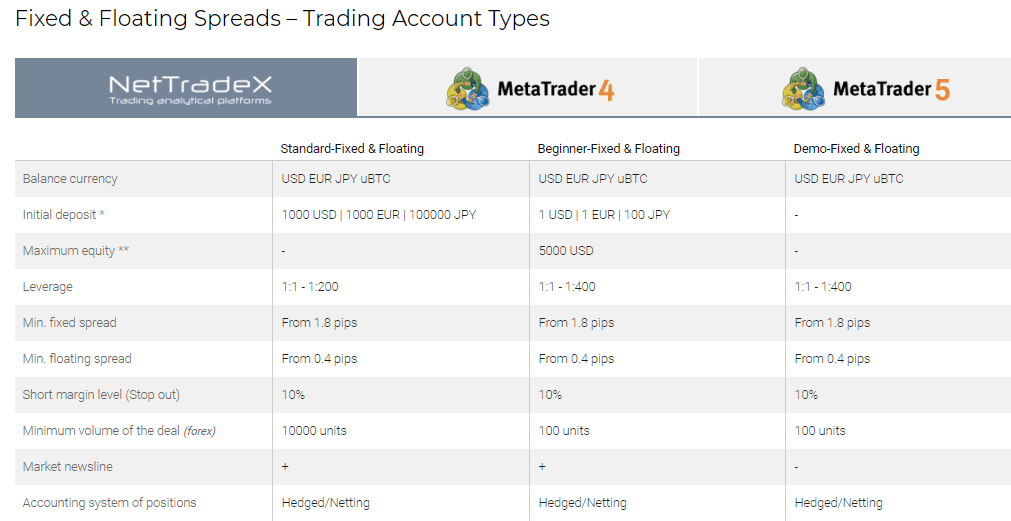

IFCM had gone through different trading requirements, manage to secure the most salient, and offer a few exchanging accounts either with fixed or floating spreads. The IFCM also permits free Demo accounts that work with virtual assets so that a user would be able to test procedures.

Through the IFCM, you are also given a chance to get the VIP account with highly adaptable exchanging conditions, customizable individual instruments, free access to a VPS, 0 commissions on stores and withdrawals, and more.

IFC Markets Spread

IFC Markets offers focused exchanging techniques and spreads. You can choose either a fixed spread or moving spread, depending on what your trading endeavor requires. Accordingly, the spread is reliant on the record type you pick. For this, you may also look at another provider, FXPrimus.

IFC Markets Rollover

One should also think about rollover or medium-term expenses as expenditures in a venture. These would be charged on the positions held longer than a day. Statements are charged or discounted by the particular measure generated by an instrument.

Trading Accounts are also made available for those who are within the Islamic areas.

IFC Markets Leverage

Leverage is one’s gateway to a lot of cash, and it can amplify the preliminary parity. However, the trader here is at an equal chance of both profit and loss; as such, the trader should know how to make good use of leverage.

Worthy of note, the IFC’s leverage levels are mediated by administrative limitations, specifically residency or other territorial matters. Along these lines, exchanging with European IFC Markets bears the greatest leverage levels, which are set to 1:30 for Forex instruments. Exchanging with its offshore branch allows one up to 1:300.

IFC Markets Payment Methods

Ways of payment for the IFC may be done by installment. IFCM does this through Wire Transfers, Credit cards, WebMoney, Skrill, Neteller, OKPAY, Unistream, and through account exchanges.

The IFC Markets Deposit

The IFC Markets is set apart by funding option and commissions. For the most part, the base amount to open an account is at 1$.

Deposit Fees

IFC Markets had made quite a stride to cover charges for deposits and withdrawals. However, it must be noted that these covers are only available to certain strategies. These you should check with client support as a few differences are depending on the country.

For withdrawals, similar may be employed depending on the supplier.

So Why Choose IFC Markets?

The IFC Markets is all about improvement in existing systems. It offers a far-reaching scope of Trading tools in Forex and CFDs. The plan of action depends on straightforward and trustful relations with the customers through the setup and STP execution with a scope of stages, incorporating the exclusive stage with amazing highlights.

IFC Markets also boasts of efficient client service in different languages.