FXPCM Broker Review: How good is it?

FXPCM is a British broker that works with Forex and CFDs. The full name of the company is Forex Capital Market, and it was founded in 1999. It is an old name on the market and therefore, it is well known among traders. However, you should always make sure that the broker is really trustable. That is why we have prepared this FXPCM review to see the real truth about this broker.

About FXPCM

The main shareholder of the Forex Capital Market is the Jefferies Financial Group which is listed on the NY Stock Exchange. The broker is considered to be a safe choice because it has many years of successful experience. Also, it is regulated by the United Kingdom FCA and Australian ASIC. These are very serious authorities that are trusted worldwide.

FXPCM has offices in Canada, the UK, and Mauritius. Yet, if you live in the United States, you cannot work with this company.

The broker operates an ECL model and prioritizes its clients’ success. It is an important detail when it comes to the selection of a broker. You would choose a broker who cares more about its clients than its profits. Right?

Traders are given access to a very big list of currency pairs and other assets. They also get the best trading software in the industry. Let us have a closer look.

What can you trade with FXPCM?

As we have already said, FXPCM specializes in Forex and CFDs trading. There is a total of 39 currency pairs and 32 CFDs. The broker lets users spot trade and copy-trade. Cryptocurrencies, however, cannot be traded separately, only in CFDs.

The company also provides options and futures trading. More information on all the choices can be found on the official FXPCM website in the “Products” section.

Fees at FXPCM

The fees at FXPCM are not high, but they are also not the lowest in the industry. Comparing its fees with other brokers is very difficult, so we have decided to simplify it for our readers.

First of all, the average spread for the EUR/USD pair is 1.3 pips. If you look at the All-in-Cost EUR/USD Active, the average spread is already smaller: 0.7 pips. There are discounts for active traders or users with VIP-status.

It is also important to note that users with standard accounts have to pay an amount indicated in prevailing spreads. If you are an Active Trader, you only have to pay the commission per trade and have a discount for the previous type of spreads.

Mobile trading at FXPCM

The broker has thought of mobile users and lets its clients work without PCs. They combined the Trading Station and MT4 platform to give traders software with many features and availability of algorithmic trading. There are many advanced tools that can be used to increase your profits.

In the application, there are around 60 indicators that can be used. You can create trend-lines with the smallest details thanks to the possibility to zoom in the position. However, the Trading Station software for mobile phones or tablets lacks a watch list. Keep in mind that the instruments you select to be shown are synchronized on all your devices.

Account types

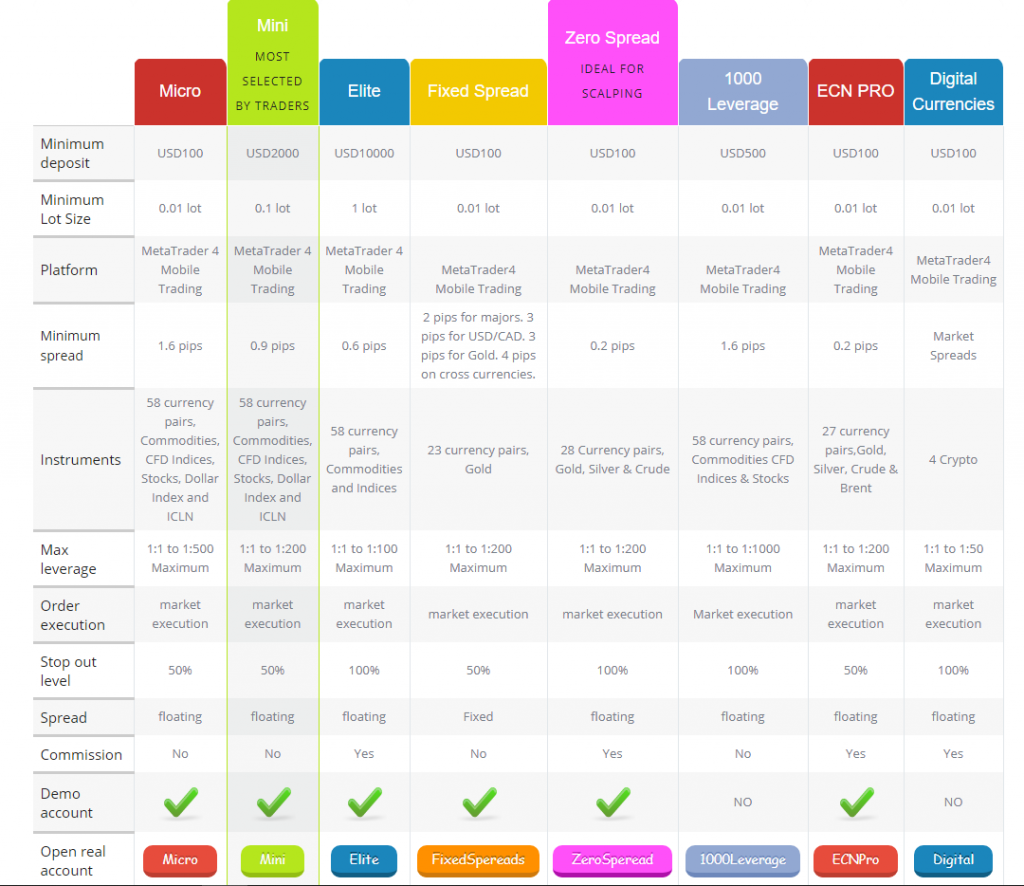

With this broker, there are eight account types. These are:

- Micro

- Mini

- Elite

- Fixed Spread

- Zero Spread

- 1000 Leverage

- ECN PRO

- Digital Currencies

The minimum deposit to start working with the company is $100. Your minimum lot size will be 0.01 and the minimum spread will be 1.6 pips. These numbers are indicated for the Micro account type and can be changed by moving to another investment plan. Here is a table from the broker’s official website that shows all the information:

It is important to note that FXPCM also provides Islamic accounts or, as they are also called, swap-free accounts. This lets traders following the Muslim faith and Sharia Law keep on working with Forex.

Customer service

Customer support is an important part of a broker. Who else will solve an occurring issue if not them? We have checked the way the customer service works here and were satisfied. It usually took less than an hour during work time for a support agent to answer us. The answers were quite professional and solved most of the requests in the first two messages.

FXPCM user opinions

Another important element everyone should pay attention to when choosing a broker is the user reviews, which can tell us a lot about a specific company. Of course, there are many fake opinions and satisfied customers do not always leave reviews, but there are still some we have to pay attention to.

Here is what a user with a name Shervin thinks about the broker.

He is sure that this is the best company based on his experience due to good customer support and quick servers.

Another user, Nathan, did not say a lot, but he stated that the company always withdrew his funds on time.

He has been working with the company for over 1 year and has had no issues.

Conclusion

FXPCM is one of the oldest brokers in the industry with a decent reputation. Although its website does not look very attractive, the company provides high-quality service and can be trusted for many reasons. It is regulated by an authority with a good reputation and has a lot of positive reviews on the internet.

There are different account types for traders of all kinds. You only need $100 to start trading. The fees are not very high, although they are not the lowest. What was your experience with this company?